Who and how increases sales by 300% during the period of self-isolation?

coronavirus , sales , retail , Happiness provider , ozon , goods.ru , marketplace , new retail forum , e- com , e- commerce

The increase in demand for adult goods, reported by online platforms and analysts, generates not only jokes about the fertility surge by the end of the year, but also many strategic and practical issues that retailers are now facing . Experts and practitioners in the adult goods industry shared analytics, forecasts and recommendations for market participants.

Ozon Adult Product Sales Data → illustration No.2 in the slider

Pandemic and 18+ products: offline, online, marketplaces

“With the beginning of self-isolation offline sales of adult products have stopped. In online stores, we are seeing a decline of 10-20%. It cannot be called critical yet, but it nevertheless exists. In part it is associated with the rapid growth of sales of this category of products on marketplaces. We, as a wholesale company, are growing steadily,” – said Dmitry Korobitsyn, CEO of “Supplier of Happiness”. He noted that there were no cardinal changes neither in distribution of demand for certain categories of goods nor in the company structure of popular brands against the background of the current situation, and goods for women showed the largest growth in April compared with the first two weeks of March (82%).

Sales structure in the category of intimate goods of the “Supplier of happiness” company → illustration No. 3 in the slider

“The traffic of most online stores of intimate goods has been smoothly creeping down since the beginning of the year, as goods of this category began to be actively sold at marketplaces”, – said Timofey Shikolenkov, the co-founder of “Two Sensei Bureau” in his analytical review . According to Timofey, periodic peaks in attendance at certain sites are associated with e- mail newsletters that bring a one-time short-term effect and turn into a “burning of the base”.

At Ozon, traffic in the adult product category increased 2.5 times compared to the peak New Year period, and the number of orders increased 3 times. The growth is provided by increased demand not only for condoms, but also for sex toys, which since the beginning of the year have grown within the category to 47%. In April the growth in sales of goods for adults (excluding condoms) is 382% (compared with April 2019). The categories of erotic lingerie, BDSM and sex toys have increased their popularity 6.5 times, and that of intimate cosmetics have grown 4 times. “If we talk about the sources of traffic, then we have equal shares of transitions from both the catalog and search engines. That is, somewhere around 50% of our customers come to us through organic search”, – said Alexandra Denisova, the head of the Adult Products category at Ozon .

Ozon adult sales growth statistics → illustration No. 4 in the slider

On the goods.ru marketplace, the category grows by tens of percent for the third month in a row. The greatest growth during this period was shown by sex dolls (714%), souvenirs and board games for adults (351%) and sets of sex toys (299%). At the same time, purchases in this category on average began to be made by customers of the marketplace more often: before that customers ordered sex products once every three months, now they place an order every two months. 40% of buyers of adult goods come to goods.ru just for them, the rest buy them along with goods from other categories. “In terms of assortment, our category is presented very well. We took care of people who for some reason cannot be together – we have a separate gradation of goods with remote control. To attract customers, we make increased cashbacks for sex products. In addition, we have joint projects with partners, within which we combine several products into one proposal. And we are constantly delighting our users with new collections,” – said Ivan Panteleev, managing the category“Adult Products ”goods.ru.

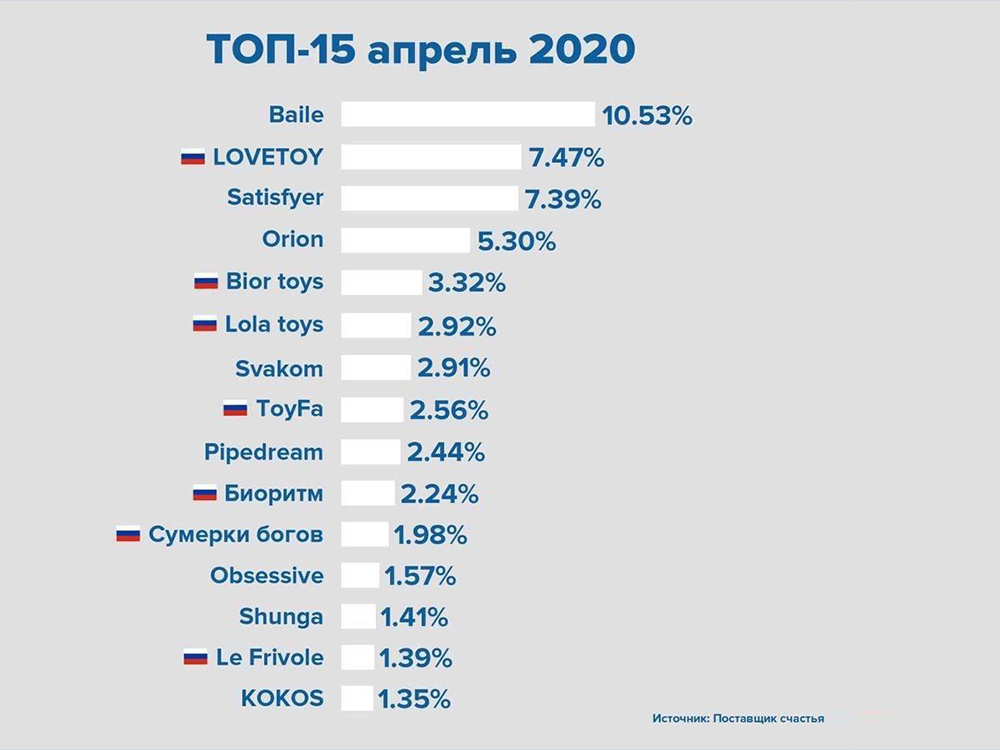

Dmitry Korobitsyn noted that there is still room for new players in the sex market. According to the “Supplier of Happiness“ company, in the top 15 players in the market for intimate goods, the number of Russian brands and manufacturers has grown from 4 to 7 over the year.

Top 15 players of the market of intimate goods according to the “Supplier of Happiness“ → illustration No. 5 in the slider

What do retailers do during the coronacrisis?

“All previous crises have shown that the industry is always growing,” – says Dmitry Korobitsin. – “We, as a wholesale company, are responding to the situation by expanding stocks and developing infrastructure to ensure stable operation under conditions of possible total quarantine.” In the event of the introduction of severe restrictions on movement, the “Provider of Happiness" even rented a block of rooms for employees at the hotel closest to its warehouse. The inventories of the “Supplier of Happiness” are formed for three months, while the company has no resources to store goods for a longer period. At the same time, the company is working on expanding the warehouse and developing IT.

Offline retailers are now worried about whether it is worth investing in the development of their own infrastructure, or is it easier and faster to get to marketplaces , which are experiencing rapid growth in a pandemic, move the market forward and can be a quick anti-crisis solution for those retailers who do not have access to online . “But it’s also important for retailers to develop their own expertise,” – said Dmitry Korobitsyn. “In the category of products for adults there is an assortment that does not require consultation and can be successfully sold on marketplaces. But there are also such products for the sale of which the expertise of sellers and retailers is required, high-quality content delivery and a site search system. No matter how hard they try, marketplaces will not fully cover this category”, – commented Dmitry. If companies plan to “play long” in the market, in any case, they need to invest in the development of their expertise and infrastructure. So, according to Dmitry, D2C in the adult products category will remain relevant. “It is clear that a very large market share is now being redistributed towards marketplaces, which you also need to be able to work with. But the possession of expertise, the ability to recommend, analyze, build the best offer will always be appreciated”, – said the head of the “Supplier of Happiness”.

The importance of marketing and building quality communication with customers was also noted by Timofey Shikolenkov. “Virtually no one is engaged in serious marketing of adult goods, even large players regard this as a regular product category,” – said Timofey, “But in the intimate products category it is very important to understand your target audience, what they are interested in right now, its needs and characteristics of consumption. Among people buying 18+ products, there are both beginners and sophisticated consumers, and you need to speak different language with each target group”.

For effective work with marketplaces, Aleksandra Denisova recommended that sellers of intimate goods pay more attention to the competent compilation of product cards and their placement in the correct section.

Organizers of the webinar “E- com here and now: goods for adults”.

UPGRADE is a series of business events for retailers.

Bureau of expert support for business “Two Sensei”. Two Sensei are Timofey Shikolenkov and Sofia Fridman, recognized experts in the Russian e- commerce industry, working in this field for more than 20 years. Two Sensei Online University helps to develop and maintain staff competencies for successful business development in the field of e-commerce, offering expert business support and one-click creation of a corporate university.

Comments (0)

Чтобы оставлять комментарии, необходимо авторизироваться.